The Ultimate Guide To Pvm Accounting

The Ultimate Guide To Pvm Accounting

Blog Article

Pvm Accounting Things To Know Before You Buy

Table of ContentsOur Pvm Accounting DiariesGetting The Pvm Accounting To WorkThe Definitive Guide for Pvm AccountingPvm Accounting Things To Know Before You BuyNot known Facts About Pvm AccountingWhat Does Pvm Accounting Mean?

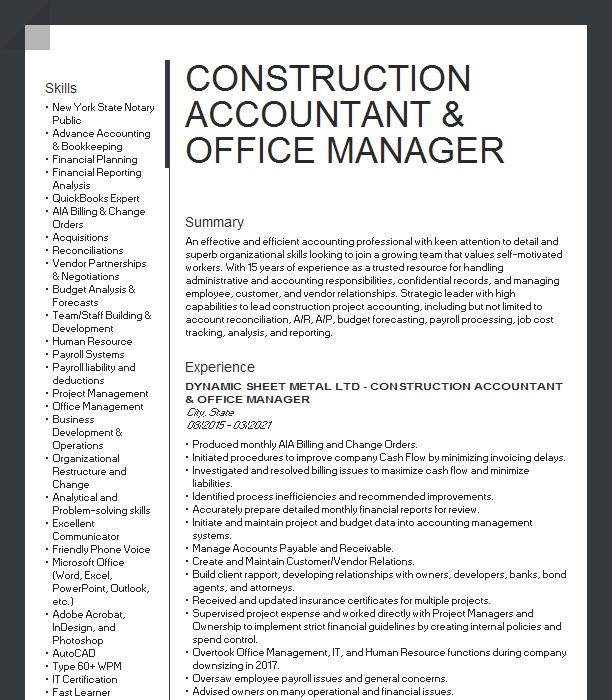

Make sure that the accountancy procedure complies with the law. Apply required building and construction accounting standards and procedures to the recording and coverage of building task.Understand and maintain common price codes in the audit system. Communicate with numerous funding companies (i.e. Title Firm, Escrow Firm) regarding the pay application process and demands required for payment. Manage lien waiver disbursement and collection - https://www.cheaperseeker.com/u/pvmaccount1ng. Display and resolve bank issues consisting of cost abnormalities and check differences. Assist with carrying out and preserving interior monetary controls and procedures.

The above declarations are planned to define the basic nature and level of work being carried out by people assigned to this classification. They are not to be construed as an extensive list of duties, obligations, and abilities needed. Workers may be required to perform duties outside of their regular obligations periodically, as required.

The Basic Principles Of Pvm Accounting

Accel is seeking a Building Accounting professional for the Chicago Workplace. The Building Accountant executes a variety of accountancy, insurance compliance, and job management.

Principal duties include, however are not restricted to, taking care of all accounting functions of the business in a prompt and exact manner and offering records and timetables to the company's CPA Firm in the preparation of all monetary statements. Makes certain that all accounting procedures and functions are managed accurately. Accountable for all monetary documents, pay-roll, banking and day-to-day procedure of the accounting function.

Functions with Job Managers to prepare and post all month-to-month billings. Generates regular monthly Task Cost to Date records and working with PMs to reconcile with Job Supervisors' spending plans for each project.

Pvm Accounting Can Be Fun For Everyone

Proficiency in Sage 300 Building and Realty (formerly Sage Timberline Office) and Procore building and construction monitoring software application a plus. https://www.figma.com/design/pEGqwVkdxaWH6r5PgQiEyD/Untitled?node-id=0%3A1&t=BbE3XCPdNiLo7e15-1. Have to additionally be efficient in other computer software program systems for the prep work of records, spreadsheets and other bookkeeping evaluation that may be called for by administration. financial reports. Have to have solid business abilities and ability to prioritize

They are the financial custodians who make sure that building and construction jobs stay on budget, this website follow tax policies, and keep economic openness. Construction accounting professionals are not simply number crunchers; they are strategic partners in the building process. Their main function is to take care of the economic aspects of building tasks, ensuring that resources are assigned effectively and economic risks are lessened.

Pvm Accounting - An Overview

By preserving a limited grasp on job finances, accounting professionals help stop overspending and monetary setbacks. Budgeting is a keystone of successful building and construction jobs, and building and construction accountants are instrumental in this respect.

Navigating the complicated web of tax guidelines in the construction sector can be challenging. Building and construction accounting professionals are skilled in these policies and make certain that the job abides by all tax obligation requirements. This includes handling payroll taxes, sales tax obligations, and any type of various other tax responsibilities details to building and construction. To master the duty of a building accounting professional, people require a strong educational foundation in audit and finance.

Furthermore, certifications such as Licensed Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Construction Industry Financial Professional (CCIFP) are very concerned in the market. Functioning as an accounting professional in the building and construction sector features an unique set of challenges. Construction projects commonly entail limited target dates, transforming laws, and unanticipated expenses. Accounting professionals must adjust promptly to these obstacles to keep the job's monetary health and wellness intact.

The Pvm Accounting Diaries

Ans: Building and construction accountants create and check budgets, identifying cost-saving possibilities and guaranteeing that the project remains within budget. Ans: Yes, building accountants take care of tax conformity for building tasks.

Introduction to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make hard options among many economic alternatives, like bidding process on one project over one more, choosing funding for materials or equipment, or establishing a project's profit margin. In addition to that, construction is an infamously volatile sector with a high failure rate, slow-moving time to payment, and irregular cash flow.

Common manufacturerConstruction organization Process-based. Manufacturing entails repeated procedures with quickly identifiable prices. Project-based. Production requires various processes, products, and devices with differing expenses. Repaired area. Manufacturing or manufacturing occurs in a solitary (or a number of) regulated places. Decentralized. Each project occurs in a new area with varying website conditions and one-of-a-kind difficulties.

Not known Factual Statements About Pvm Accounting

Lasting connections with suppliers ease negotiations and enhance effectiveness. Irregular. Constant use different specialty professionals and providers impacts performance and capital. No retainage. Payment arrives in full or with normal settlements for the complete agreement quantity. Retainage. Some section of settlement might be withheld until project completion also when the contractor's work is finished.

Routine production and short-term agreements lead to manageable cash circulation cycles. Uneven. Retainage, sluggish payments, and high ahead of time prices cause long, uneven cash money circulation cycles - financial reports. While typical makers have the advantage of regulated environments and maximized production processes, building and construction business must constantly adjust to each brand-new project. Also somewhat repeatable tasks call for adjustments as a result of website conditions and other factors.

Report this page